Introduction: A Smarter Path to Investment Property Financing

Securing financing is one of the biggest challenges real estate investors face when trying to scale their portfolios. Traditional lenders often require extensive income verification, high credit scores, and strict debt-to-income (DTI) ratios, making it difficult for self-employed investors, entrepreneurs, and property flippers to qualify for loans.

That’s where EDSCR (Economic Debt Service Coverage Ratio) investment loans come in. These loans offer a hassle-free alternative, allowing investors to qualify based on property income potential rather than personal income verification.

Whether you’re looking to purchase a rental property, renovate a fixer-upper, or finance a new construction project, EDSCR investment loans provide fast, flexible, and scalable financing solutions that make it easier to fund your next deal.

🔹 What is an EDSCR Investment Loan?

An EDSCR loan is a financing option designed specifically for real estate investors. Unlike traditional loans that require W-2s, tax returns, and personal income verification, EDSCR loans focus on the income generated by the investment property itself.

Key Benefits of EDSCR Loans:

✔ No W-2s or tax returns required – Ideal for self-employed investors.

✔ Faster approval process – Get funding in days, not weeks.

✔ Qualification based on property income – Not personal DTI ratios.

✔ Great for scaling – No limits on the number of properties you can finance.

📢 Bottom Line: If your investment property generates enough rental income to cover its loan payments, you can qualify for financing—without the traditional paperwork.

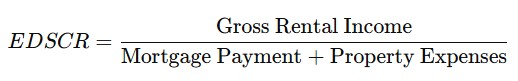

📊 How EDSCR Loans Work: A Simple Formula

Lenders use a simple EDSCR formula to determine loan eligibility:

✔ If EDSCR is 1.25 or higher: Your property generates enough income to cover its debt—lenders love this!

✔ If EDSCR is between 1.0 – 1.24: You may still qualify, but lenders may ask for reserves.

✔ If EDSCR is below 1.0: Your property doesn’t generate enough income, and you may need a higher down payment.

📢 Investor Tip: Many lenders base rental income on market rent estimates rather than actual lease agreements, making it even easier to qualify!

🏡 Why EDSCR Loans Are the Easiest Way to Fund Your Next Investment Property

✅ 1. No Personal Income Verification

Traditional lenders require tax returns, pay stubs, and employment history—which can be a challenge for self-employed investors or those with multiple properties.

With EDSCR loans:

✔ Approval is based on property income, NOT personal income.

✔ Investors can keep their financial records private.

✔ Easier qualification for high-net-worth investors with significant write-offs.

📢 Investor Tip: If you reinvest most of your earnings into properties, EDSCR loans allow you to qualify based on rental cash flow rather than taxable income.

✅ 2. Fast & Streamlined Approval Process

The traditional mortgage process can take weeks (or even months) due to income verification, underwriting, and paperwork.

With EDSCR loans:

✔ Faster underwriting process – Many approvals happen in days.

✔ Minimal paperwork – No need for tax returns or employment verification.

✔ Quick closings – Get deals done before the competition.

📢 Investor Tip: The speed of EDSCR financing makes it ideal for hot real estate markets where quick closings matter.

✅ 3. Perfect for Scaling Your Portfolio

Many traditional lenders limit the number of mortgages an investor can hold, making it difficult to grow a rental property empire.

With EDSCR loans:

✔ No limits on the number of properties financed.

✔ Easier approval for investors expanding their portfolios.

✔ Works for both long-term rentals and short-term rentals (Airbnb, VRBO).

📢 Investor Tip: If you plan to buy multiple properties, EDSCR loans offer the flexibility to grow without financial roadblocks.

✅ 4. Flexible Loan Terms to Fit Your Strategy

Whether you’re a buy-and-hold investor, a fix-and-flipper, or a short-term rental owner, EDSCR loans can be tailored to your needs.

✔ Interest-only loan options to maximize cash flow.

✔ Fixed or adjustable rates to suit long-term strategies.

✔ Loan terms from 5 to 30 years depending on your investment goals.

📢 Investor Tip: Choose interest-only payments during renovations to keep costs low until the property starts generating rental income.

💡 How to Qualify for an EDSCR Loan

Unlike traditional loans, which require personal tax documents, qualifying for an EDSCR loan is simple.

Basic Requirements:

✅ EDSCR Ratio of 1.0 or higher (1.25+ preferred)

✅ Down payment of 20-30% (varies by lender)

✅ Credit score of 680+ (some lenders accept lower)

✅ 6-12 months of cash reserves for mortgage payments

📢 Investor Tip: Even if your credit score isn’t perfect, strong rental income and equity can help you qualify.

🏗 Best Property Types for EDSCR Loans

🏡 Long-Term Rentals – Single-family and multi-unit properties.

🏠 Short-Term Rentals – Airbnb, VRBO, and vacation homes.

🏚 Fix-and-Flip Properties – Finance the purchase and rehab.

🏢 Mixed-Use & Commercial – Rental-based businesses.

📢 Investor Tip: EDSCR loans are ideal for properties that generate strong rental income, regardless of location or type.

🚀 Final Thoughts: Why EDSCR Loans Are the Smartest Choice for Investors

If you’re looking for the easiest way to fund your next investment property, EDSCR loans offer unmatched flexibility, speed, and scalability.

✔ No personal income verification required – Qualify based on rental income.

✔ Faster approvals & minimal paperwork – Get funding in days.

✔ Perfect for portfolio growth – No restrictions on multiple properties.

✔ Works for various investment strategies – Long-term, STRs, fix-and-flips, and more.

🔹 Bottom Line: If you’re ready to grow your real estate business without the hassle of traditional financing, EDSCR investment loans are the fastest and easiest way to fund your next deal.

🚀 Start exploring EDSCR financing options today and take your investments to the next level!